Tax return 2018 for me and my wife as a student?

I have a question and although I have a full time job and my wife is a student (no job) and in the tax return, I'm not sure if I should enter the things (contributions, travel costs, laptop, materials.) Of my wife and if so! Where should I enter it?

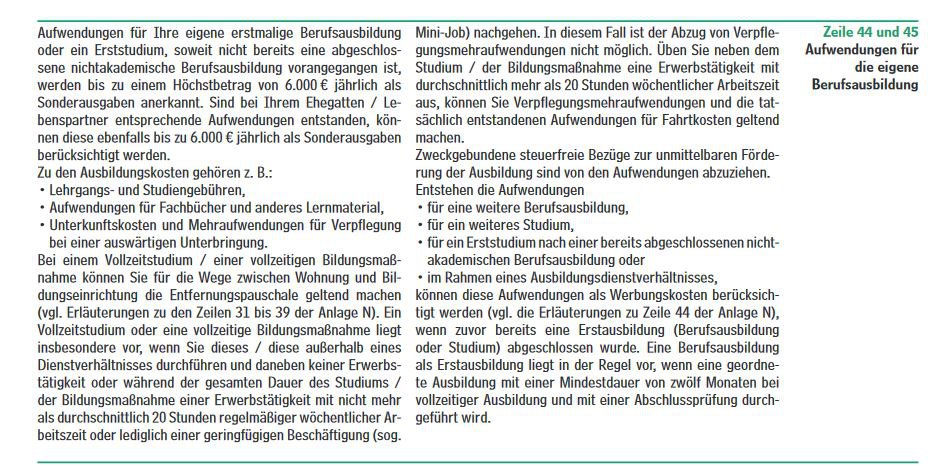

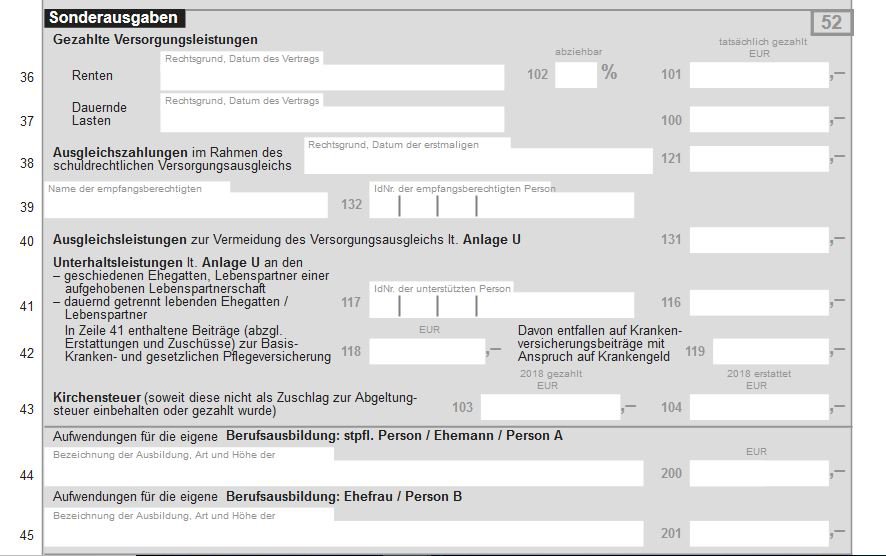

If it is a first degree, the expenses are currently still special expenses.

But where exactly in the application? Do you mean for advertising costs in special cases?

As already mentioned, in the special editions

It is ONLY a caste with "Applications for your own vocational training: wife / person B" here you meant? The student contributions I can unfortunately enter. There are a few things like ticket / materials / Laptop.haben you have an idea?

Yes, consult a tax consultant!

Expenses for one's own vocational training: wife / person B "

You make a statement of costs and pay the total amount there.

Otherwise, I join Helmuthk.

According to the instructions for the EC tax declaration 2018: